Weeks of Stock & Rate Of Sale

Weeks of Stock (WOS), sometimes also referred to as Weeks of Cover (WOC), is a key performance indicator (KPI) that all retailers should watch closely to understand the health of their inventory.

WOS is a measure of how many weeks the inventory for a particular item or a category will last at the current or forecasted Rate of Sale (ROS).

Merchandising is full of abbreviations, but we felt we wanted to highlight these two, as they are key in optimising your store’s performance and stock health.

Table of Contents

How to calculate Weeks of Stock

Looking at inventory levels in terms of WOS is a much better way to evaluate your inventory than absolute inventory levels because of a few reasons:

-

WOS gives a measure of whether current inventory levels are healthy or not, i.e. are we carrying too much inventory or too little inventory?

It would not be possible to answer this without comparing inventory levels to Rate of Sale (ROS).

-

WOS allows you to compare inventory levels across different types of products. For example, a retailer might carry thousands of units for a fast moving product like socks. However, they may only carry tens of units for a slower selling item like outerwear.

Using a metric like WOS provides a standardised KPI that can be used across all product categories.

In the early days of retail, merchandise and assortment planning were done on a much smaller scale, particularly by “mom-and-pop” stores that dominated city centers. These small, family-owned shops catered to their local communities, and their inventory was often a reflection of their intimate understanding of customer preferences. Shop owners relied on personal relationships with customers to predict demand and make buying decisions. Without the aid of modern technology, they used instinct and years of experience to determine what products to stock and when to replenish.

Weeks of Stock Formula

Let’s assume that we are calculating WOS for a Basic White T-Shirt, of which we currently have 250 units on hand (Beginning of Period Inventory) and we do not have anything on-order. In this case BOP Units = 250.

Now, let’s look at the ROS Units (Rate of Sale Units) for this T-Shirt. Let’s assume that this item has sold at a weekly average of 50 units per week in the trailing 4 weeks. In this case, ROS Units = 50.

Using these metrics, the WOS will equal to 250 / 50 = 5, meaning that at this Rate of Sale, our inventory will last us for another 5 weeks.

A few questions naturally arise from the calculation above:

Is 5 a good value for WOS?

Why are we looking only at the trailing 4 weeks?

How many weeks back should we look at in general?

What if our business is very seasonal, and the trailing 4 weeks is not a good proxy for the upcoming weeks?

We will cover the answers to these questions in the rest of this post.

One thing to highlight is that the calculation above for WOS makes the assumption that trailing weeks are good indicators for the future, which is not necessarily true for highly seasonal products.

For example, most fashion retailers will see their sales spike during the holiday season, so leading into the holidays, trailing 4 weeks will not be a good indicator for the past. The right way to calculate WOS is to use a forward looking demand forecast, instead of historical rate of sale.

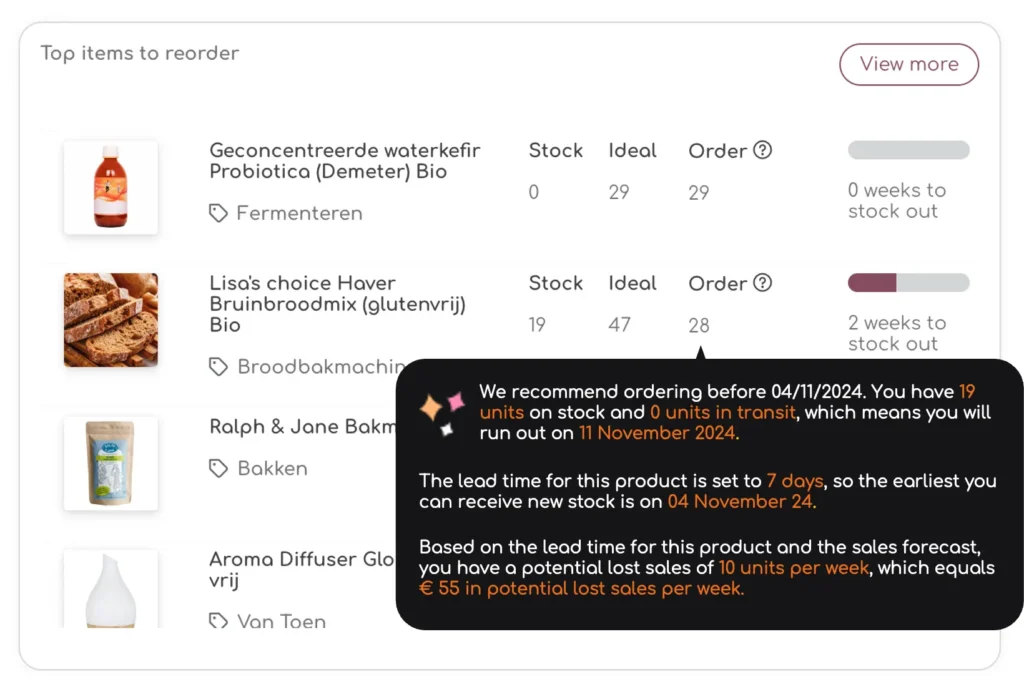

Touchless planning handles unexpected changes in demand by using artificial intelligence and machine learning to analyze data and make quick recommendations. It automates routine tasks, allowing planners to focus on exceptions and more complex scenarios.

Our engine can detect changes, such as shifts in consumer behavior or external factors, and adjust forecasts accordingly.

This approach enhances operational efficiency by providing real-time insights and enabling proactive decision-making

Small business owners can benefit from touchless forecasting tools in several ways:

Conclusion

The potential for touchless planning within companies is vast, providing significant benefits such as improved forecast accuracy through advanced AI engines and increased planner efficiency by minimizing unnecessary interventions and overrides. However, planners must adapt to this new process, which emphasizes input while reducing manual output adjustments at critical moments. In touchless planning, it’s essential for planners to trust the system to make decisions on their behalf.

This requires that business owners embrace some loss of direct control and decision making power as part of a more efficient and accurate data driven buying process.

With this in mind, it’s essential to establish a clear vision for the future roles of planners. This involves shifting from routine overriding to more valuable activities, such as scenario planning and collaborating with other functions like marketing and commercial teams.